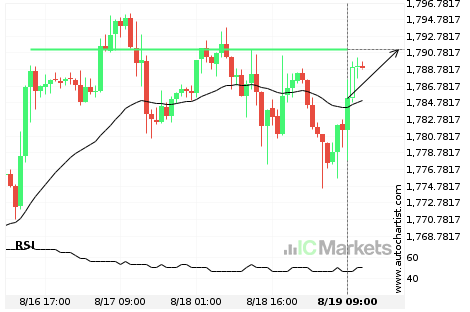

GOLD Nível visado: 1791.2400

Aproximando-Resistência nível de 1791.2400 identificado em 19-ago-2021 09:00 UTC

SILVER Nível visado: 23.5220

Cunha descendente identificado em 19-ago-2021 06:00 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 23.5220 no próximo 12 horas.

GOLD Nível visado: 1778.3715

Triângulo quebrou na linha de suporte em 18-ago-2021 11:00 UTC. Possível previsão de movimento em baixa nos próximos 15 horas para 1778.3715

SILVER Nível visado: 23.4462

Cunha ascendente quebrou na linha de suporte em 17-ago-2021 15:00 UTC. Possível previsão de movimento em baixa nos próximos 17 horas para 23.4462

GOLD Nível visado: 1789.2700

Cunha ascendente identificado em 17-ago-2021 05:30 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 1789.2700 no próximo 8 horas.

Grande Movimento SILVER

SILVER experimentou um 1.41% em alta movimento no(a) último(a) 6 horas.

GOLD Nível visado: 1741.6400

Canal ascendente identificado em 16-ago-2021 03:30 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em baixa para o nível de 1741.6400 no próximo dia.

Grande Movimento SILVER

SILVER experimentou um 2.29% em alta movimento no(a) último(a) 28 horas.

SILVER Nível visado: 23.5870

Canal descendente identificado em 12-ago-2021 19:15 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 23.5870 no próximo 23 horas.

GOLD Nível visado: 1747.9831

Cunha ascendente quebrou na linha de suporte em 12-ago-2021 10:00 UTC. Possível previsão de movimento em baixa nos próximos 7 horas para 1747.9831